Understanding Market Cycles: Lessons from Bull and Bear Markets in Canada

If you had invested $100,000 in the U.S. stock market on January 1, 1960, that investment would have grown to an astounding $51,318,138 by December 31, 2023.

This growth occurred despite numerous market drawdowns and periods of volatility.

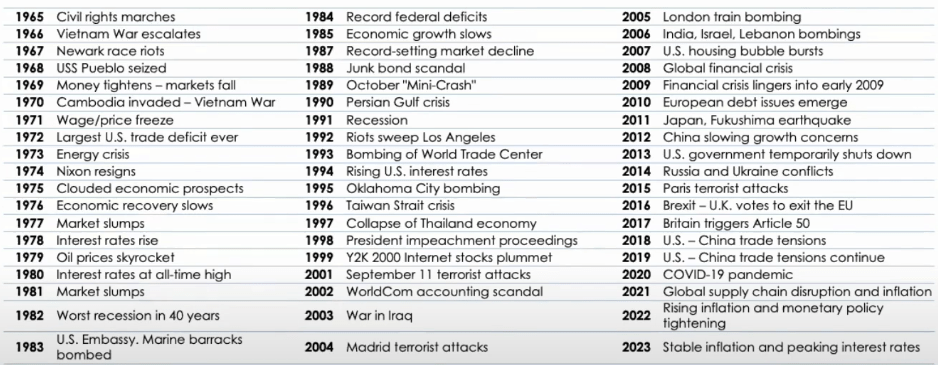

In today’s global economy, it’s easy to feel overwhelmed by the constant flux of events—be it the war in Ukraine, U.S. elections, or rising inflation and interest rates. Investors often find themselves wondering if “this time is different.” But the reality is that while the circumstances may change, the fundamental principles of market cycles remain the same.

Why do stock markets go up and down?

Stock markets go up and down due to a variety of factors that influence investor behaviour and market behaviour, including:

- Supply and demand (more investors trying to sell a stock rather than buy)

- Company performance (release of earnings reports, for example)

- Herd behaviour (investors following other investors’ behaviour)

- Economic indicators (for example, if an interest rate is lowered by a central bank – like the Bank of Canada – borrowing becomes cheaper, which can boost the market)

- Regulation changes

- Market crashes due to overinflated prices based on a speculation that didn’t come true

- Geopolitical turmoil (which impacts investor confidence and volatility)

Market volatility is something every investor must come to terms with. As we’ve seen in recent years, from the COVID-19 pandemic to the 2008 Global Financial Crisis, the markets respond to global events with varying degrees of intensity. However, despite the ups and downs, markets have consistently shown a capacity for recovery.

Investing is much like the changing seasons. When you’re in the depths of winter, it’s hard to see when spring will arrive, but you know that eventually, it will. Similarly, in the market, we don’t know how long or severe a downturn will be, but history shows us that recovery always follows. Just as spring leads to summer, bull markets inevitably follow bear markets.

Timing the market is notoriously difficult. Instead of trying to predict when to buy or sell, it’s better to stay invested for the long term. As the saying goes, it’s about “time in the market” rather than “timing the market.”

Bull and bear markets in Canada

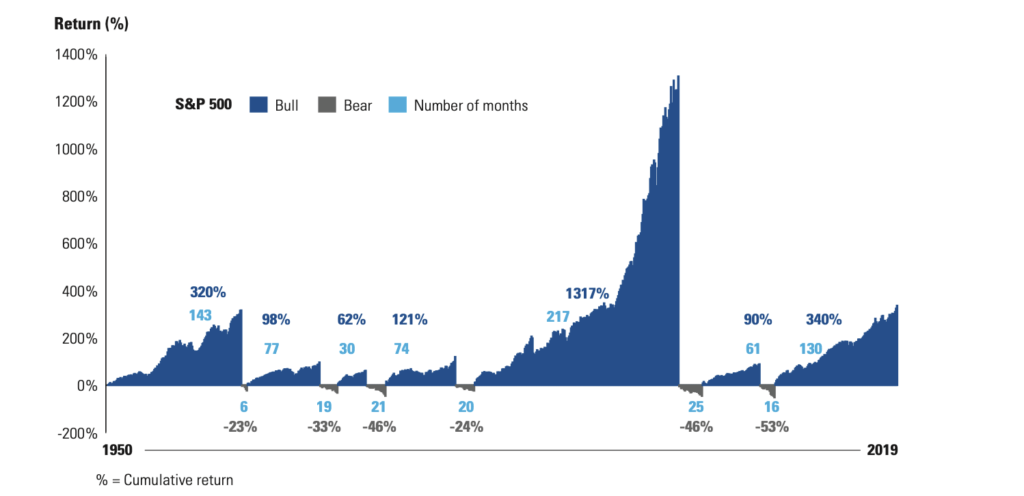

To illustrate this concept, let’s look at the historical data from the Canadian stock market. Since 1955, the average bull market (when the stock market or a particular asset class is rising) has lasted about 78 months, with a 193% gain. Conversely, bear markets (when the stock market or a particular asset class is declining), which are shorter and less frequent, have an average duration of only 11 months with a drawdown of only -32%.

These statistics clearly show that the bulls outweigh the bears, both in terms of duration and returns.

The key takeaway?

Don’t let short-term market declines shake your confidence. The long-term growth potential of the market far outweighs temporary setbacks.

What are market downturns and drawdowns?

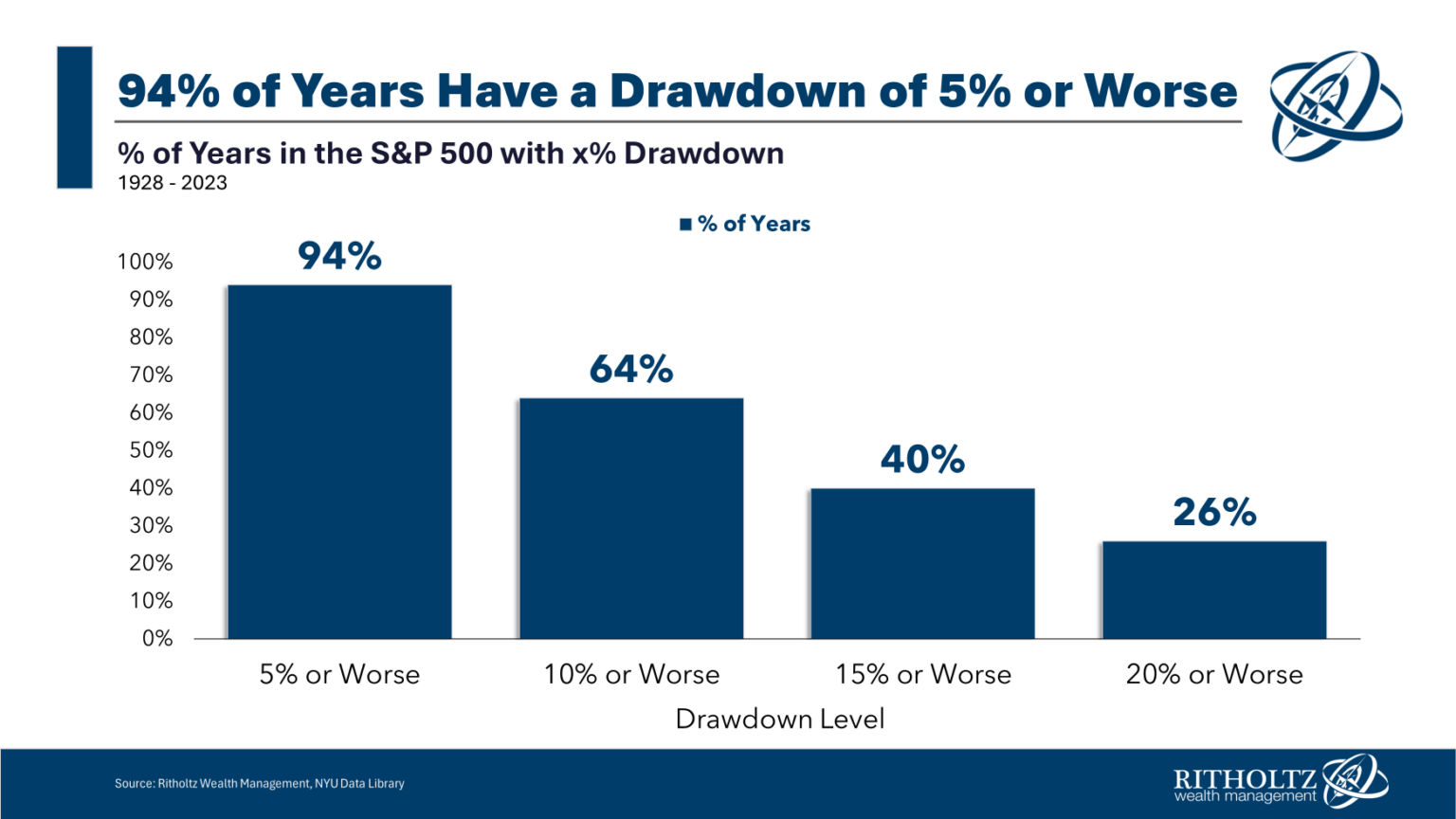

A market drawdown refers to the decline in the value of an investment or market index from its peak to its lowest point over a specific period. For example, if a stock reaches a high of $100 and then falls to $80, the drawdown is 20%.

Market corrections—defined as a drop of 10% or more in the market—are a normal part of the investment landscape. In fact, 94% of the years since 1928 have seen a drawdown of 5% or worse. However, despite these corrections, the market has continued to grow over time.

It’s important to remember that corrections are not only normal but also necessary for the health of the market. They serve to reset valuations and create opportunities for savvy investors. The critical point is to stay the course and not panic during these periods of decline.

Stay Invested

Market cycles are inevitable, and volatility is something every investor will experience. Rather than trying to predict and time these cycles, focus on staying invested and maintaining a long-term perspective. History has shown that markets recover, and those who remain patient are rewarded.

At Impact Wealth, we’re here to help you navigate these cycles and make informed decisions that align with your financial goals. Whether you’re just starting your investment journey or looking to refine your strategy, our team of financial advisors is ready to provide the guidance and support you need.

Want to learn more about how to protect your investments during volatile times?

Connect with us today to explore how we can help you achieve your financial goals with confidence.